What happened in the markets - 10-14 July 2023

Introduction

Things don’t always turn out the way investors would like them to: another rate hike is due in the US, and there is no clear evidence of major stimulus measures in China yet. Taking these factors into account, analysts look in this week’s Research Weekly at ways in which investors can deal with the situation.

Key Takeaway on this week

At 3%, CPI is now just one-third of where it peaked a year ago. Inflation is slowing across a growing number of categories, lessening the pressure on the Fed to keep hiking.

Another hike in the US interest rate seems likely at the next Fed meeting, but the case for further tightening weakens.

Investors in the Chinese market should focus on state-owned enterprises and high-dividend stocks.

Despite the market's hefty gains, analysts see an opportunity to 1) diversify into the lagging segments of the equity market that carry lower valuations, 2) dollar-cost-average to take advantage of the potential for higher volatility, and 3) extend duration within fixed-income portfolios.

A lot to like in June's CPI when looking at the details

Headline inflation for June came in at 3%, cooler than expected, and sharply lower from the previous month's 4% reading. This is the slowest pace in more than two years and the 12th straight month of improvement since inflation peaked in June of last year at 9.1%. Excluding food and energy, CPI rose 4.8% from a year ago, the slowest since October 2021, but still way above the Fed's target.

A look under the surface reveals that inflation is slowing across a growing number of categories, making the June reading likely a pivotal one in helping shape views about how far the Fed must push.

Goods – Even with only a modest drop in used-vehicle prices, goods inflation declined 0.1% month-over-month. The good news here is that based on timely industry data, used-car prices will likely come down more. The Manheim Used Vehicle Value Index, which tends to lead the used-car price component of the CPI by a couple of months, fell 4.2% in June from the previous month and 10.3% from a year ago. That was the biggest monthly drop since early in the pandemic, suggesting further easing in price pressures in this key driver of core inflation.

Shelter (housing) – Housing was once again the largest contributor to the increase in core CPI, but the June monthly rise was the smallest increase in rents since the end of 2021. Based on the historical lags between when inflation of newly signed rental contracts falls and when it shows up in the official data, we would expect housing inflation to continue to improve in the months ahead.

Services excluding shelter – This "supercore" measure that the Fed has highlighted, which is largely a function of the labor market, continued to improve in June, falling to 4%, also the smallest increase since December 2021. The easing in this bucket of inflation was helped by a decline in airfares, likely driven by lower jet fuel prices, which probably won't be repeated. Nevertheless, the fact that services inflation continues to cool, even with unemployment near historic lows, is noteworthy.

Inflation continues to cool, taking some pressure off the Fed

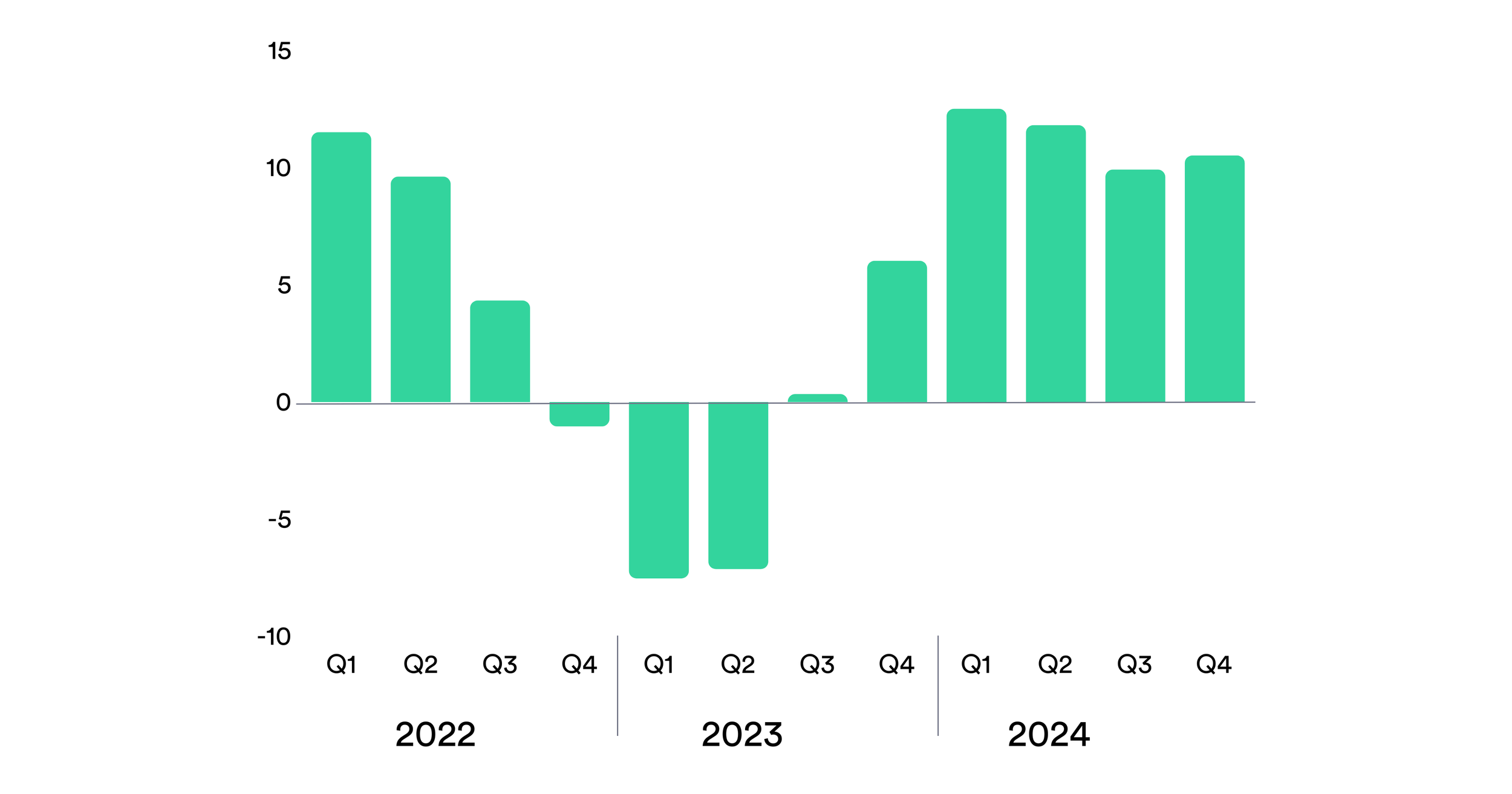

The graph shows that at 3%, headline CPI is now just one-third of where it peaked a year ago. Core inflation remains elevated but is also on a downward path.

US rates likely to increase and stay at peak level

The US labour market showed further signs of cooling in June but probably not enough to dissuade the Fed from hiking rates once more, as labour demand still looks strong. Against this backdrop, analysts expect that the Federal Open Market Committee (FOMC) will prefer to proceed with its plans to raise the federal funds target rate by 25bps later this month. With the US economy seemingly digesting tighter monetary policy quite well, it is looking increasingly likely that interest rates will stay at their peak level for longer. Analysts expect the Fed to hold off on rate cuts until at least March next year.

Analysts believe the best response in the case of the US is to use the recent weakness and lack of stock market breadth year-to-date to pick up individual stocks. For example, our technical analysts see interesting picks in the transportation (UBER, GRAB) and logistics business (AMZN). The fact that transportation stocks triggered medium-term buy signals as of late is noteworthy, since transportation stocks tend to be good leading indicators for the overall economy. This will also be one of the core topics of the upcoming earnings season as of the end of this week.

Chinese equities: Opt for state-owned companies and high dividends

This weaker than expected policy intention in China has resulted in disappointing market performance. Pessimistic investor sentiment and light investor positioning may buffer the market from significant downside, but analysts think the market will likely be stuck in a trading range with low turnover for the rest of 2023.

Global investors who are looking to recalibrate their China positions may take advantage of any market rebound in the coming weeks due to rising policy expectations. Analysts maintain our preference in the Chinese market for state-owned over private enterprises, and analysts recommend high-dividend stocks and dividend growers. The internet sector is now cyclical in nature; within the sector, analysts prefer online gaming: SEA (SE) and online travel: Alibaba (BABA)

Consensus is expecting an earnings recovery ahead

S&P 500 consensus earnings growth estimates, year-on-year

Looking beyond the Q2 numbers, analysts see two key tailwinds for earnings growth in the second half of this year. First, comparables will get easier: earnings in H1 2022 grew by 10% but only by 1% in H2 2022. Second, the US dollar should shift from being a headwind to being a tailwind in the second half of the year.

The stalling recovery of the Chinese economy poses a headwind, but more so for European equities than for their US counterparts. The share of S&P 500 revenue coming from China is rather limited at approximately 5%. Overall, analysts recommend staying invested with a focus on quality growth (information technology: AAPL, MSFT, META; communications: TMUS, VZ) coupled with some defensive plays, healthcare: UnitedHealth (UNH), Eli Lilly (LLY).

Three potential market opportunities based on three macroeconomic themes

Broadening of market participation: As two of the biggest headwinds for markets in 2022 — inflation and Federal Reserve policy — have started to turn favourably, the foundation for the next bull market is likely being formed. This year market leadership has stayed very narrow, with just a handful of mega-cap technology stocks accounting for the bulk of this year's gains. Beyond the largest seven S&P 500 companies by market-cap, gains are more modest. Analysts therefore see an opportunity to rebalance as appropriate and diversify into the lagging segments of the equity market that carry lower valuations. These include value-style investments, small-cap companies, traditional cyclical, defensive sectors, and international stocks.

Dollar-cost averaging as volatility likely picks up - As time passes, analysts think the impact of higher interest rates will be felt, and growth could weaken, as some leading indicators suggest. Buffers like the pandemic savings and strong labor market remain, but volatility could make a comeback. Yet the strong first half of the year has historically been associated with further gains for the remainder of the year. To avoid trying to time the market and to take advantage of the potential for volatility, analysts recommend investors dollar-cost-average by investing systematically at regular intervals.

Good time to add duration exposure in fixed income: There were also encouraging signs on the fixed income market, with yields at the long end doing a step-up in the first full week of the second half of the year. The 10-year US Treasury yield, a bellwether indicator, crossed the 4% mark again last Thursday and is once again approaching the highs of late last year. However, analysts would refrain from interpreting too much into the erratic yield developments currently observed and regard current levels as attractive entry points to add some duration exposure if not done already.

Source: Julius Bär, EdwardJones